Understanding analyst ratings, scores, or placements

Analyst ratings, scores or placements are useful, but misinterpreted or over emphasized can lead buyers to very bad decisions. For example, the analyst has an ideal customer, that customer is typically the largest enterprises with the most complex needs and largest budgets (have to be able to afford the analyst). Their ratings, scores, and placements of products on their annual reports illustrate this most typically when they assign “Leaders.”

Analyst ratings, scores or placements are useful, but misinterpreted or over emphasized can lead buyers to very bad decisions. For example, the analyst has an ideal customer, that customer is typically the largest enterprises with the most complex needs and largest budgets (have to be able to afford the analyst). Their ratings, scores, and placements of products on their annual reports illustrate this most typically when they assign “Leaders.”

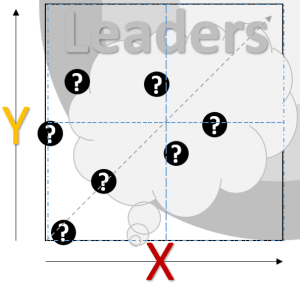

Leaders, Beyond the X and Y

Many things go into rating, scoring, or placing software vendors as Leaders. While the X and Y axis may give a simple definition, what you may not always recognize is the nuanced data and analyst interpretation that went into making that placement.

One of the most interesting data points is the software vendor’s global presence (global offices, global customers, global implementations). If you are a major global entity, this might be important to you (might), but you must ask yourself, why is their presence and global customer base that important to me? To be certain, this is not a conversation about localized software prompts, menus and manuals, nor is it about the products ability to impact localization or translation; truly it is just a matter where they have offices and customer.

Another thing to consider is the further out on the joint axis they are the more likely it is also an indicator of price they will charge you for their software and and for many of these very robust systems, the cost to implement the solution.

Software and Service Behemoths

If you see major software brands, the ones who have enterprise ERP, BI, Big Data and other products, as well as global solutioning teams, and they are in the leader’s quadrant, but not very far in, it is likely their global presence, size of their customers, size of the software company and the years they’ve in business that has pushed them there, not necessarily the fortitude of their software.

Integration

The ugly industry secret. As the large payers buy up smaller niche leaders, there is this assumption that they will make the products work seamlessly together, however in most cases, this positioning never comes to fruition. The possibly bought the niche vendor for getting more customers to sell their other products into. Rarely is it a product road-map decision. In fact, these very large players often struggle to continue selling these acquired products, sometimes abandoning them from innovation, or just ignoring them completely.

With the sophistication of open architectures and APIs, most systems can be made to talk to each other, pushing and pulling data, but not always beautifully; but that isn’t a deal breaker. If the systems can talk, no matter how unattractively, it can be useful.

Analyst’s Disadvantage

The analyst I’ve met seem to come from industry and are trying to do a good job, but their need to positive impact the firms’ revenue (they are revenue generating companies) may create a fuzzy line between objectivity and cozying up to the software vendors; however that isn’t the biggest challenge, what is harder the analyst’s ability to know if what the software vendor is telling them about their road-map and how well positioned (financially, technologically, etc.) they are to complete the vision is true. They have to do a little water witching to find a reasonable answer. Interviewing their customers (analyst) to see how implementations have gone in the past, how they (end customers feel about the solution, etc).

The Analysts Ideal Customers

This cannot be over-focused. You have to ask yourself when using analyst ratings and looking at leaders, am I an analyst customer, if not, why? I cannot afford them? Why? Because I am not big enough? I know, in your mind you are big; however there are degrees of big and degrees of enterprise. If your company is not a subscriber or client of the analyst, why?

This one piece of information about who your most influential analyst is should help you know how to use their ratings. Your most ideal software vendor may not be in the “leaders” category. That category may have vendors whose other products suit your need but their WCM products may not be ideally suited for you, and as we’ve already mentioned, the seamless integration is a myth.

Your ideal software

In conclusion, I give this analogy from the perspective of buying AdWords. In Google AdWords buying wisdom, buying the number one spots and the last spots may not be the best investment. The number one spot may be too expensive for the results. The last spot on the first page may be too low to be effective for your time frame. Somewhere in the middle could be the intersection of value and results. When choosing your WCM software, the middle space could be where your ideal software answer lies.